Whilst making a Will is something we should all do, many put it off to another day, after all, death it’s not something we particularly want to think about.

However, if you want your wishes to be followed upon death, then a Will is the only way to guarantee this.

If you haven't already made a Will - then you are not alone

No matter your age or circumstance, it is vital that you make a Will to ensure clarity about what you want to happen to your estate after your death and who will benefit.

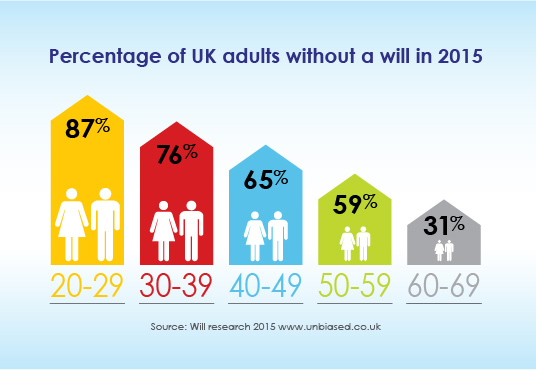

How do you compare to others in your age bracket?

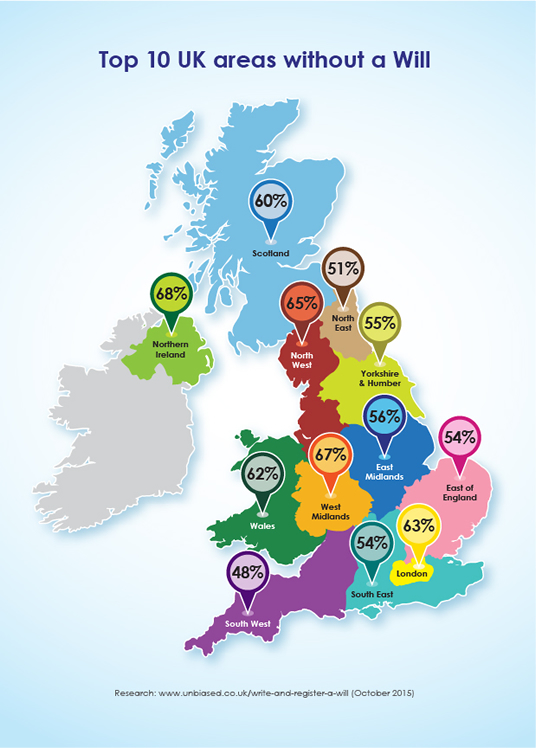

How do you compare to others in your region?

How much are you worth?

Take in to consideration your house, possessions, savings, investments, your business - everything you own.

Surely you would want to ensure that your 'estate' (everything in the list above) goes to those you want/your loved ones? If you don't have a Will then you risk your estate going to the taxman or those you would prefer not to inherit.

Estate Planning puts you in control, minimises your estate's exposure to several threats, preserves your assets and gives you peace of mind.

If you die intestate (without a Will) your spouse or Civil Partner won’t automatically inherit all you’ve worked so hard for, your children could be at risk and an unmarried partner would inherit nothing.

Is your Will up-to-date?

Your circumstances are constantly changing and the changes should be reflected in your Will. Frankly, an out-of-date Will or a DIY Will can be worse than no Will at all and they should be reviewed at least every five years.

Are you sure your Will meets your changed circumstances? Does it really reflect how you wish to dispose of your wealth?

What happens if you die intestate (without a Will)?

Do you know what intestacy or partial intestacy will mean?

• If married – your spouse will not necessarily get everything and your wealth may go to those you do not want to get it

• If not married – your partner will get nothing

• Married or not – minor children will have no appointed guardians and may be at risk of being put into care

• In some cases – your estate may have to meet unnecessary costs and tax

• In all cases – there will be muddle, distress and probable family upset

If you are joint owners of the family home

• Do you hold the house as Joint Tenants or as Tenants in Common? Do you understand the difference?

• Does your Will position your house (and other assets) effectively to preserve its (their) value?

Has the Will writer offered a review? What has changed?

• Have you got married, formalised a Civil Partnership, are you about to marry? (Marriage revokes a Will).

• Have you started living with your partner in a long term relationship?

• Have you broken up a long term relationship, divorced or had your marriage annulled?

• Has your spouse or partner died? (If within 2 years a Deed of Variation is possible)

• Has your spouse, partner or a beneficiary become disabled or terminally ill?

• Have children been born? (Guardians should be appointed in a Will)

• Has the birth of grandchildren changed your wishes as expressed in your current Will?

• Has your relationship with an executor changed? Do you still want him/her to act?

• Has an executor become too ill to act, become bankrupt, died or moved abroad?

• Have you or any one mentioned in your Will changed names?

• Have you disposed of any property which you specifically bequeathed in your Will

• Have you acquired more property?

• Have you bought your first or more property in UK?

• Have you bought a property abroad or in Scotland? (Your global assets are subject to UK inheritance tax)

• Do you have an overseas Will? (And a Scottish Will for property north of the Border)

• Are you confident that your UK and overseas Wills do not revoke each other?

• Have you started any new Life Assurance policies or Pension Plan?

• Are they written in Trust?

• Are the benefits of your occupational Pension Plan and Death in Service benefits written in trust? Is your former spouse or Civil Partner still

• nominated as a beneficiary? Is that what you want?

• To what extent has your Inheritance Tax (IHT) exposure changed?

• Have you received an inheritance?

• Have you set up or bought a new business?

• Has the combined value of your and your spouse’s or Civil Partner’s estate – everything you own - risen above the Nil Rate Band (NRB)?

• If your spouse or Civil Partner has died – did he or she use their tax free NRB in their Will?

• Do you know what documents and information are needed when applying for the transfer of their NRB?

• Will the provisions of your parents’ Will make your own IHT position worse?

• Have you talked to your parents about their Wills?

• If your adult children are exposed to IHT, does your Will make their tax position worse?

• Have you thought about leaving money to your children and /or grandchildren in a Trust?

What if you lose your mental capacity?

Who will manage your affairs and make decisions for you? Those you trust and have your best interests at heart or a Court official? Don’t leave it to chance – put yourself in control while you can!

As you can see, there is so much consider when writing a will, it is so important to get professional advice. To have a chat about your situation and options, please use the "Contact Me" button below to ask any questions or to arrange a no-obligation meeting to discuss your requirements.

"Thanks to Lee's help and professionalism we have just settled into our new home"

Colin, London

"Thanks for making the whole process quick and painless"

Lula, Hertfordshire

"Lee is professional, consistent and always there to answer queries we both had. He made the whole process seem so easy"

Holly, Leeds

"I was recommended to you by a friend and would pass your details on every time"

Lucy, Bradford

"We wholeheartedly convey our thanks for all your valuable support"

Mr & Mrs Pallanti, London

"I just wanted to email you to let you know how pleased we are with the advice that Lee Naylor has provided us with over the past few months."

Steve & Suzzanah, West Yorkshire

"I have found the service provided by Lee to be very friendly and professional. I really appreciate the personal touch he provided"

Garth, Edinburgh

"Amongst the stress and chaos, Lee was the one who was accessible, knowledgeable, professional, honest and reassuring"

Jane, Northumberland

"We would have no hesitation in recommending him and his services to anyone needing financial advice."

Hebe & Graham, Herefordshire

"Lee has always been really helpful and provided me with great advice which allowed me to sort my finances out"

Mel, Leeds

"Lee gets a five star rating from me with no improvements to be made whatsoever."

Sean, Chester

"Lee was extremely helpful and efficient and continued to work in our favour even after his contracted responsibilities were fulfilled. I can confidently say he is a most genuine and valuable adviser."

Peter, North Wales

"We would certainly recommend you to anybody thinking of going down the same path we did."

Paul, West Yorkshire

"The advice you have provided as always been sound and the service excellent."

Martyn, Leeds

The guidance provided within this website is subject to the UK regulatory regime and is therefore primarily targeted at consumers based in the UK.

Estate planning and the provision of Wills are not regulated by the Financial Conduct Authority.

Lee Naylor t/a The Will Adviser operates on behalf of APS Legal & Associates Ltd, Head office: Worksop Turbine Innovation Centre, Shireoaks Triangle Business Park, Coach Close, Worksop, Nottinghamshire, S81 8AP.

APS Legal & Associates is a member of the Institute of Professional Willwriters

APS Legal & Associates complies with the Trading Standards Institute Approved IPW Code of Practice